Dynamic portfolio management

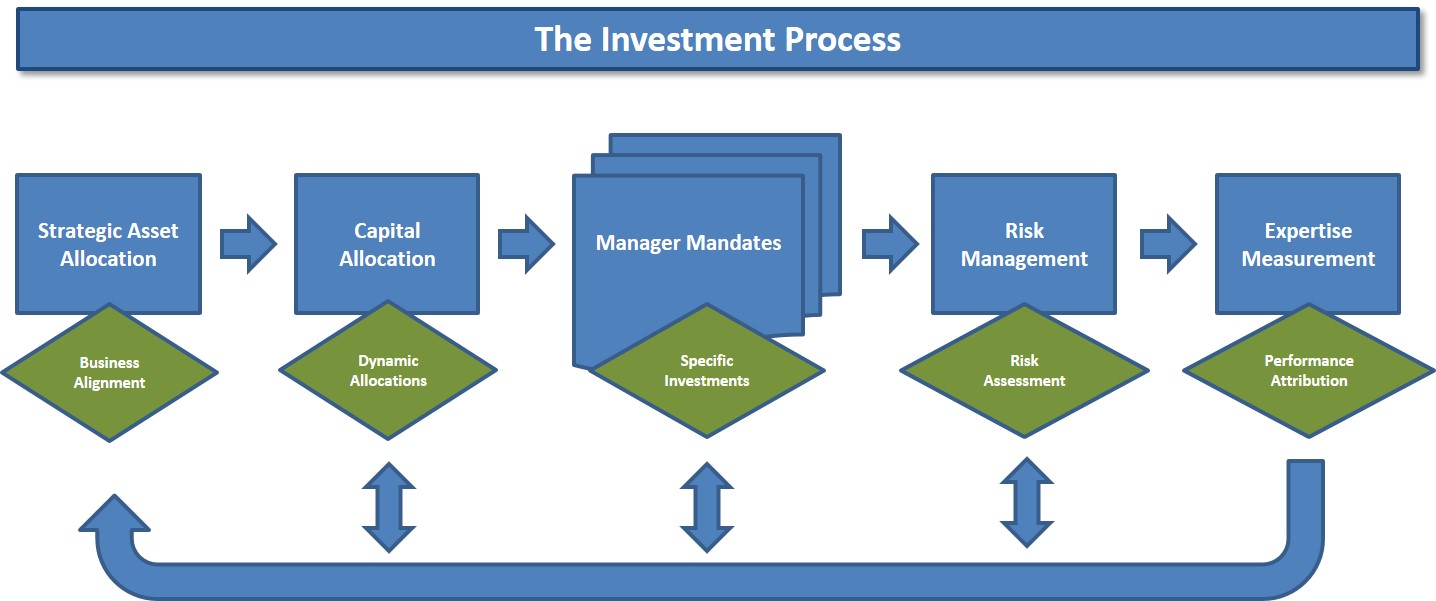

Our investment process begins with a strategic assessment of portfolio objectives and risk appetite. Senior level discussions are held with key business leaders, and result in benchmark portfolios that vary by product line and align with business needs.

With strategic allocations as a reference point, we dynamically manage the portfolio on an ongoing basis as conditions evolve. Our global economic and market outlook informs a capital allocation process that spans a wide opportunity set. Quantitative optimization tools frame discussions that involve risk and return expectations, portfolio diversification, liquidity, taxes, regulatory capital and internal conviction. Based on these discussions, we take actions intended to optimize performance and meet portfolio objectives.

These actions are formulated in a set of portfolio mandates allocated to portfolio managers both internal and external to Allstate, spanning domestic and foreign opportunities as well as public and private markets. These managers assess fundamental, valuation and technical factors to make specific investments and to generate strong returns through the investment cycle.

Our holistic risk management framework aggregates risk exposures across individual holdings and portfolios, limiting concentration risks and ensuring that risk is taken commensurately with our clients’ tolerance and appetite. Portfolio risks are incorporated in an enterprise capital framework that informs decision-making across the broader firm for our Allstate affiliate clients.

The final step of the process is a rigorous framework for performance assessment that uses internal expectations, portfolio benchmarks and external manager universes as relevant reference points. We attribute performance to its underlying components, in order to identify consistent sources of value add and opportunities for performance enhancement.