Experts on the market

Our team takes a client-centered, proactive and innovative approach. We are a group of talented portfolio managers and analysts with diverse backgrounds in the investment industry and a breadth of expertise across financial markets. You’ll find us at the forefront of the industry—active in industry groups and constantly exploring new strategies and opportunities as a part of our continuous evolution.

We seek to provide a challenging, stimulating environment that attracts, retains and develops top talent and fosters thought leadership. Our team is comprised of more than 40 research analysts and portfolio managers. We generate results and protect Allstate’s capital, making us critically important to Allstate’s overall success.

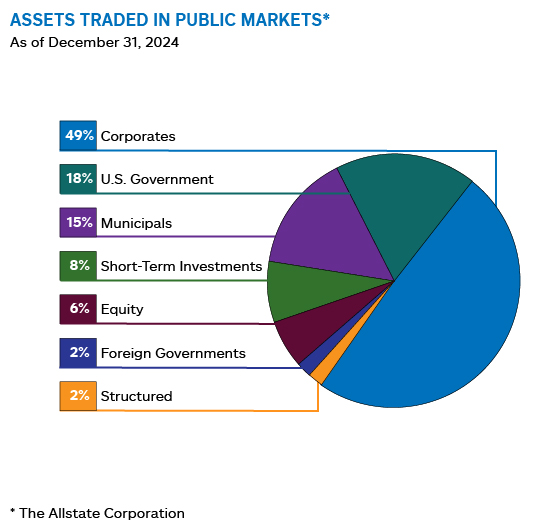

Primary asset types invested in by our Public Markets group:

Fixed income

Corporate debt

Municipal bonds

U.S. government and agencies

Asset-backed-securities

Distressed debt

Equity

Domestic active and passive

Foreign developed

Emerging markets

Short-term investments

Money market funds

Commercial paper

Derivatives

FX, fixed income, equity

Collateralized Loan Obligations (CLOs)

Allstate, through its subsidiaries, Allstate Investments, LLC and Allstate Investment Management Company (AIMCO®), is an experienced participant in the CLO market, both as an investor and a manager. As an investor, we’re active across the capital stack, moving up and down the risk spectrum based on our assessment of fundamentals and valuations. As a manager of CLOs, we look to expand their issuance in the future, allowing us to increase our reach in the loan market, while continuing to leverage our resources and generate attractive fee income. Our experienced team uses a consistent, disciplined framework for credit assessment that we leverage across the platform of CLOs we invest in and those we manage.

For questions regarding CLO investments, please contact:

Chris Goergen, CFA

Senior Bank Loan and CLO Portfolio Manager